Please see the WP eStore Tax Calculation article to learn more on eStore’s built-in tax feature.

Configuring sales tax (regional or international) when selling through PayPal is really easy if you want to use it. After you configure the sales tax, PayPal will automatically charge customers the appropriate amount when they pay for your products or services on PayPal.

![]()

Configure Sales Tax in PayPal

There is a video tutorial on how to setup regional sales tax in PayPal.

PayPal frequently updates their interface so the following screenshot may not exactly match with what you see in your profile but the general concept is the same.

- Log in to your PayPal account by visiting www.paypal.com.

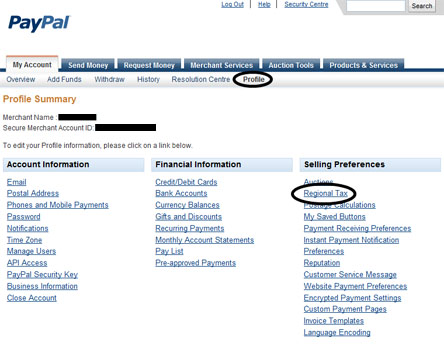

- Go to ‘Profile’ from ‘My Account’ (My Account->Profile)

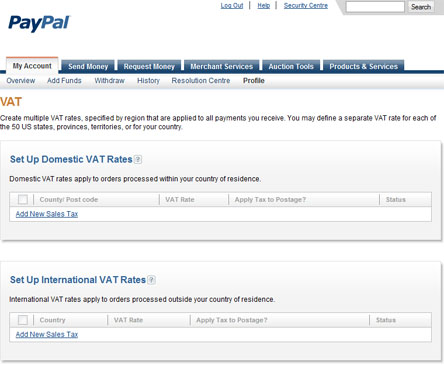

- Click on the ‘Regional Tax’ link and you will get the following screen

- Now you can add regional or/and internation sales tax in this screen.

After you configure the sales tax when a customer goes to pay for a product by clicking the ‘Checkout’ button of the WP eStore shopping cart plugin, PayPal will automatically charge the customer the appropriate tax.

If you do not wish to charge tax for a particular item (for example: a digital item) then set the individual item tax of that item to 0 (zero) and it will not charge any sales tax on that item. You can set the individual tax of a product from under the Shipping and Tax section of that product.

Please note that sales tax will be applied to the shopping cart after the customer fills in the credit card details (if paying by card) or logs into his/her PayPal account (if paying from paypal account). This is so paypal can work out the appropriate tax amount based on the customer’s location.

Note: We provide technical support for our premium plugins via our customer only support forum