The eStore TaxCloud addon allows you to integrate your store with taxcloud, a free sales tax management service, to automatically calculate tax for every address in the United States.

TaxCloud handles every aspect of sales tax management, from collecting to filing. It calculates tax in real time for every state, county, city and special jurisdiction in the US.

Installing the eStore TaxCloud Integration Addon

You can install this addon the same way you install any WordPress plugin:

- Go to the “Add New” plugins screen in your WordPress admin area

- Click the “upload” tab

- Browse for the addon file (estore-taxcloud-integration.zip)

- Click “Install Now” and then activate the plugin

Using this Addon

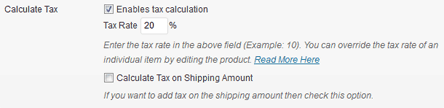

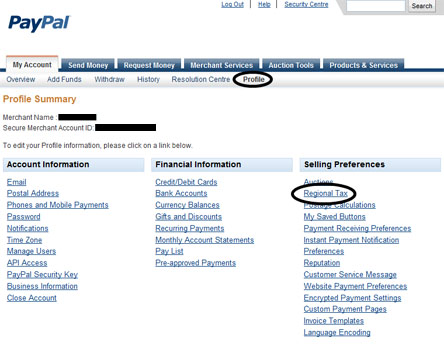

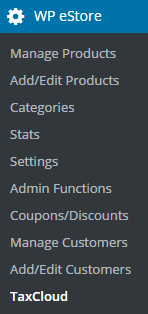

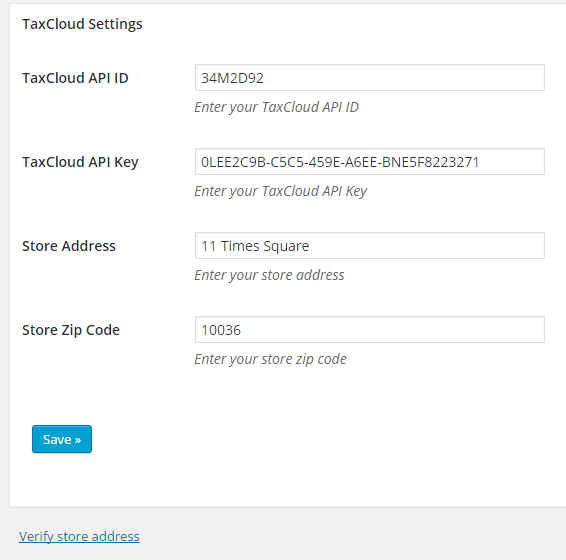

1) In order to integrate your store with TaxCloud click on the “TaxCloud” sub-menu under the WP eStore plugin menu.

2) Enter your TaxCloud credentials (API ID & API Key).

3) Enter your Store Address. TaxCloud requires this information to calculate tax during checkout.

4) Click the Save button

5) Now click on the Verify store address link. This is to make sure that TaxCloud can successfully locate the store address that you have entered. You only need to do it once.

How Does the TaxCloud Integration Addon Work

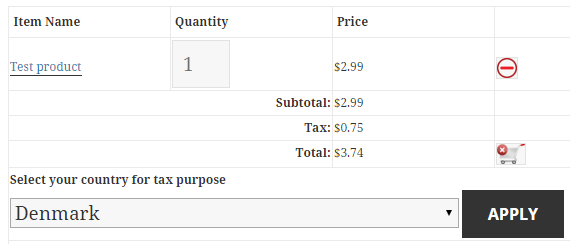

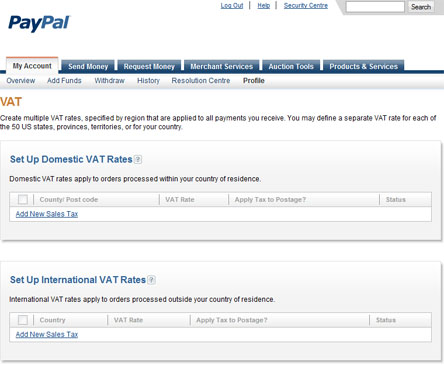

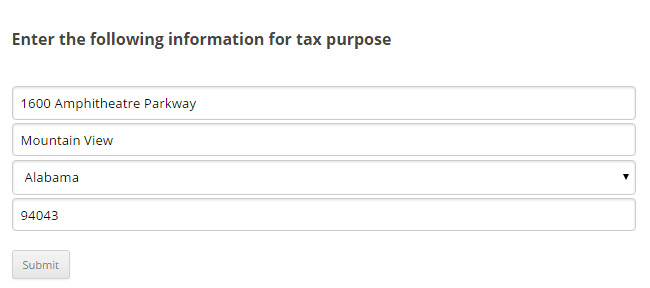

When a user clicks on the checkout button the addon will redirect the user to a page to collect the destination address.

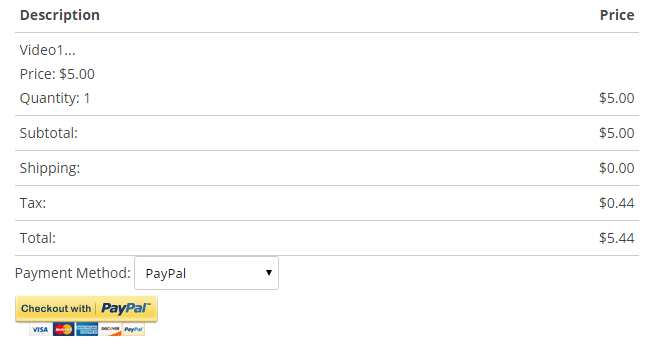

Once the address is submitted, TaxCloud will verify the address and calculate tax based on the origin (Store address) and the destination.

After the transaction is processed, the addon will notify TaxCloud that the order has been completed.

International Sales

If you are selling to international customers also then there is an option for those customers to select the “Outside US” option to bypass this.

Get the TaxCloud Integration Addon

The price of this addon is $29

Please contact us to purchase this addon.